Senior Market Sales Expands Offering to Include Financial Advisory Services with RIA Sequent Planning

Senior Market Sales® (SMS) is always thinking of ways to position insurance and retirement planning professionals to adapt to industry disruption and to thrive within it.

As the industry has increasingly moved in recent years toward a higher standard of care and more holistic planning, SMS acquired Sequent Planning, a registered investment adviser (RIA) located in our home city of Omaha, Nebraska. Registered with the Securities and Exchange Commission to do business in all 50 states, Sequent Planning can provide you with the support to offer additional services that you may not be offering to clients. SMS foresaw that owning an RIA creates several paths of opportunity for those we support, from the insurance-only agent to the broker-dealer representative.

“Just as SMS has done in decades past, we faced the latest industry disruption by looking for the opportunity within it,” said Jim Summers, SMS’ Executive Vice President, Managing Director and President. “With Sequent Planning, our advisors now can include financial advisory services, enhancing their ability to impact client lives and to grow their businesses.”

Understanding the RIA Opportunity

The push for greater transparency and higher standards of care has mounted in recent years, from numerous states’ adoption of the National Association of Insurance Commissioners’ model regulation to the federal Department of Labor’s ever-changing guidance on what constitutes fiduciary advice. Becoming or adding a fiduciary to your practice can eliminate some of the guesswork.

Working with an RIA also can help you seize the seismic opportunity of 10,000 baby boomers turning 65 every day. With regulations getting only tighter and more competition for those retirees’ money, SMS’ affiliation with Sequent Planning positions you to maintain those households by offering all-in-one-place services that appeal to consumer’s desire for convenience and that also help you work more efficiently.

Insurance agents are limited in the scope of what they can discuss with clients, providing advice only on the types of products they sell and not “investment advice.”

An RIA, as defined by the Investment Advisers Act of 1940, is a “person or firm that, for compensation, is engaged in the act of providing advice, making recommendations, issuing reports or furnishing analyses on securities, either directly or through publications.” An investment advisor representative (IAR) is a person who provides investment advice to more than five clients under the supervision of an RIA.

Becoming or adding an independent IAR to your practice allows you to provide a broader range of advice than the insurance-only agent.

Remain Independent

While some IARs are employees of the RIA, Sequent Planning IARs are independent contractors. You could be your own RIA, but serving as your own RIA can devour time that otherwise could be spent with clients. With Sequent Planning as your RIA, you get the structure and support that allows you to focus more on clients. In other words, you get the best of both worlds – the independence of owning your own business and the support and protection of a registered entity.

Because SMS has always championed the spirit of independence that drives our advisors, the RIA model developed with Sequent Planning allows independent insurance agents to continue to operate your current insurance business. The oversight of Sequent Planning should not bog you down or cut into your current insurance business. Your existing insurance business is generally considered an approved “outside business activity,” and the product sales are part of a client’s financial plan.

Keep More of What You Earn

Working with Sequent Planning has its benefits for registered reps, too. Sequent Planning will not charge a separate supervisory fee to review insurance products like some broker-dealers do.

Sequent Planning also will not require that you move to fee-based compensation instead of commission-based compensation on your insurance products. You can keep earning your commission on insurance products.

More Than One Path

For some advisors, becoming or adding an IAR may not be feasible. But with Sequent Planning, you may now be able to refer clients within the SMS/Sequent Planning family to provide the investment advice they need.

Whether you’re interested in referring clients or investing in the RIA model for your business, contact Sequent Planning at 402.953.3544 or info@sequentplanning.com. You can ask questions, discuss the opportunity and learn more about which model could work for your business.

Free Guide to Expanding Your Services

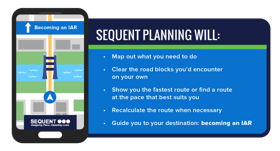

To fully understand the opportunity and the steps involved in becoming or adding an IAR, download this free guide.

“Expanding Your Services: The Opportunity in Becoming or Adding an Investment Advisor Representative” further explains:

- The numerous benefits of the RIA model

- Proprietary technology and lead programs available only through Sequent Planning

- Steps, timelines and tests for different types of professionals to become IARs

- Sequent Planning support and guidance available for exams and registrations

Adding investment advice to your services can impact client lives beyond what you’re able to now, and Sequent Planning can help make it easier than you may imagine. Download the guide and contact Sequent Planning today to explore the opportunity.

Milestone Secure Act 2.0 Is Major Boost for...

Big changes – and big opportunities – are ahead for retirement savers and the insurance and retirement planning professionals who help them.